Imagine owning a piece of a high-value property without needing a massive budget. That’s the power of real estate tokenisation. It’s taking off worldwide, making property investment more accessible, faster, and clearer.

What Is Real Estate Tokenisation?

Simply put, real estate tokenisation turns property value into digital “tokens” on a blockchain. Think of it like buying shares in a company that owns a building. Each token represents a small slice of that property’s value or ownership.

This means:

- Fractional ownership: You can buy a small percentage of a property, rather than the whole thing.

- Increased liquidity: These tokens can be traded much faster than traditional property sales.

- Digital ownership: Your ownership is securely recorded on a transparent, unchangeable ledger (the blockchain).

It’s important to remember that tokenisation works with existing legal structures. The property is usually held by a legal entity, and the tokens represent shares in that entity. This blends the stability of property with the flexibility of digital assets.

How Does It Work?

Tokenising a property involves a few key steps:

- Property Selection: A valuable, income-generating property is chosen, and all legal checks are completed.

- Legal Setup: A company is formed to own the property, and this company issues the digital tokens.

- Token Creation: Digital tokens are “minted” on a blockchain, using a smart contract to define their rules and value.

- Investor Offering: Tokens are sold to investors, often through a regulated Security Token Offering (STO), with lower minimum investments than traditional property.

- Income & Trading: Investors can earn income (like rent) from their tokens and trade them on secondary markets.

The blockchain ensures every transaction is recorded transparently and securely, reducing the need for many middlemen and potentially lowering costs.

Benefits of Real Estate Tokenisation

Tokenisation tackles common challenges in traditional property investment:

- Fractional Ownership & Accessibility: Invest with smaller amounts, opening up opportunities for more people, even across international borders.

- Increased Liquidity: Sell your investment faster than traditional property, as tokens can be traded on digital platforms.

- Lower Costs & Speed: Reduced reliance on middlemen and automated processes mean quicker, cheaper transactions.

- Transparency & Security: Blockchain provides a clear, tamper-proof record of ownership, enhancing trust and reducing fraud risks.

- Global Reach & Diversification: Easily invest in properties worldwide, diversifying your portfolio with just a few clicks.

Challenges to Consider

While exciting, tokenisation has its hurdles:

- Regulatory & Legal Hurdles: Laws vary globally, and navigating complex securities regulations is key.

- Technology & Security Risks: Like any tech, there’s a risk of bugs or hacks, and managing digital wallets safely is crucial.

- Market Adoption: The market is still young, so trading volume can be low, affecting how easily you can sell tokens initially.

Real-World Examples

Tokenisation is already happening! We’ve seen:

- The St. Regis Aspen Resort is tokenising a portion of its ownership.

- Dubai and Saudi Arabia are launching government-backed platforms for fractional property investment.

- Commercial buildings in Florida are tokenised for rental income.

- Large real estate portfolios in Japan are being offered to everyday investors through traditional banks.

These examples show that tokenisation is moving from concept to a working system, opening up property investment to a much wider audience.

The Future of Real Estate Tokenisation

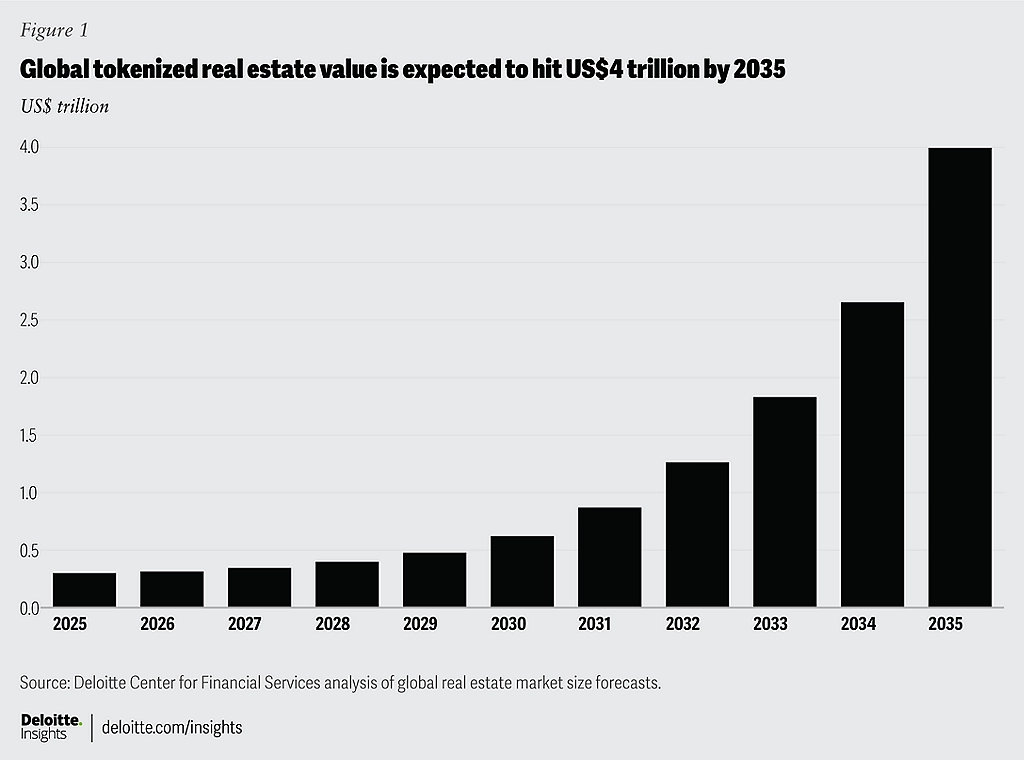

This trend is still developing, but experts predict massive growth. Deloitte, for example, forecasts that trillions of dollars of real estate could be tokenised by 2035!

Tokenisation isn’t about replacing traditional real estate; it’s about upgrading it. It makes the market more inclusive and efficient by blending physical assets with digital technology. As regulations clarify and technology improves, tokenised real estate is set to become a regular part of global finance.

Here in Lagos and the Western Algarve, while the tokenisation wave is just beginning, keeping an eye on these global trends is crucial for understanding the future of property investment.

If you’re curious about how these evolving trends might impact your property goals in our beautiful region, or if you’re just looking for that perfect Algarve villa, don’t hesitate to reach out! You can always find more insights and properties on sunnysteve.com.

What are your thoughts on real estate tokenisation? Do you see yourself investing in this way in the future?

- Are you looking for expert advice when buying a property in Lagos?

- A selection of our best “Rental Income” properties in Lagos

- A selection of the best properties in Lagos Algarve

- “Buyers Guide” Everything you need to know when buying a property in Portugal

- Thinking of selling your property? > Sell With Steve

Join The Discussion